By: Katie Moro, Vice President, Data Partnerships, Hospitality, Amadeus

You’ve heard the same phrases over and over. We’re living and working through an “unprecedented” time. Meanwhile, you’re trying to manage your business while you identify strategies to recover and bring your business back to “normal” performance. In this article for HSMAI, we’ll provide insight into three key metrics and important areas for consideration in your business during this time.

Occupancy Changes

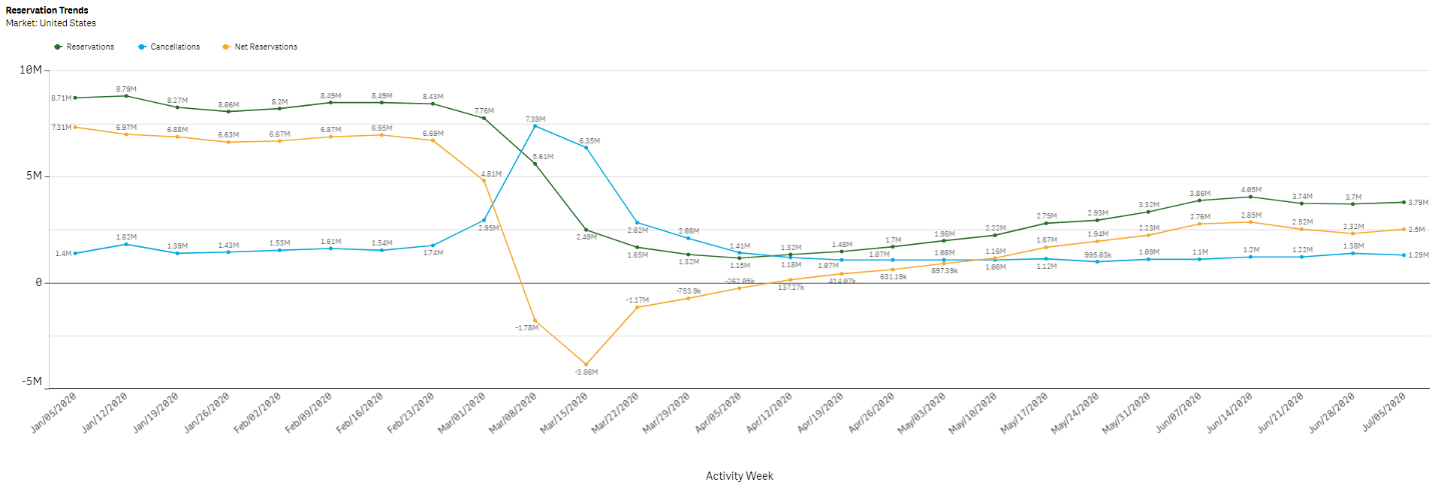

The week to week changes in demand has been unnerving to many. While the US hotel market has experienced three consecutive weeks of improved new reservations from June 21 through July 12, there has been an acceleration of cancellations during the same weeks. These fluctuations are somewhat intuitive as consumer sentiment related to travel is influenced by changes in the progression of COVID-19.

SOURCE: Demand360® data as of July 12, 2020

SOURCE: Demand360® data as of July 12, 2020

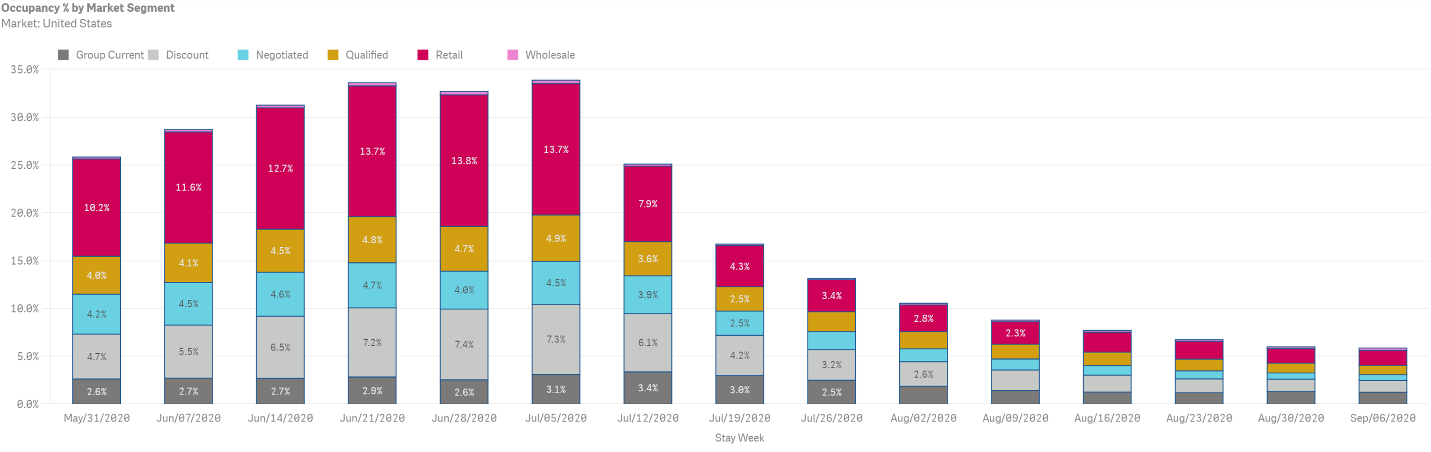

Segment Shifts

The overall increase in occupancy contribution from the retail market segment is exciting to see as it is outperforming other transient segments. In most situations, this would be an excellent scenario for profitability as these bookings typically come with a higher rate. But looking solely at occupancy numbers is only one area for consideration. As we see this increase in volume, we must also ask ourselves: At what cost do we acquire this business?

SOURCE: Demand360® data as of July 12, 2020

SOURCE: Demand360® data as of July 12, 2020

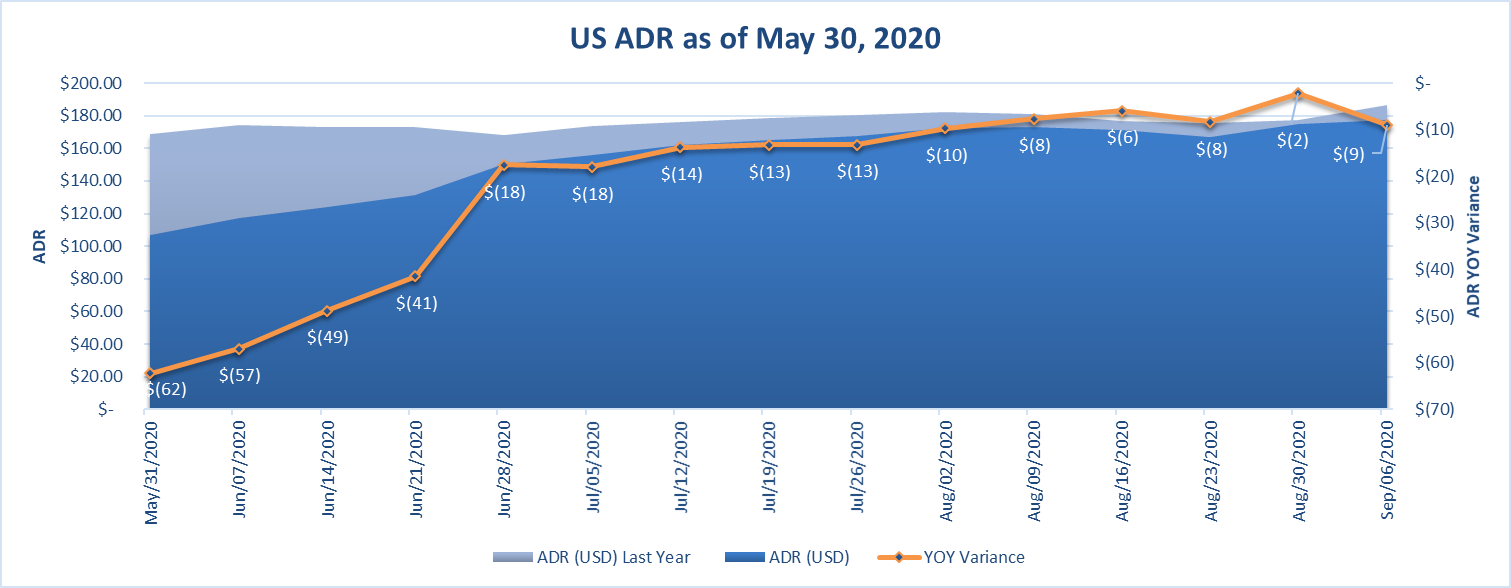

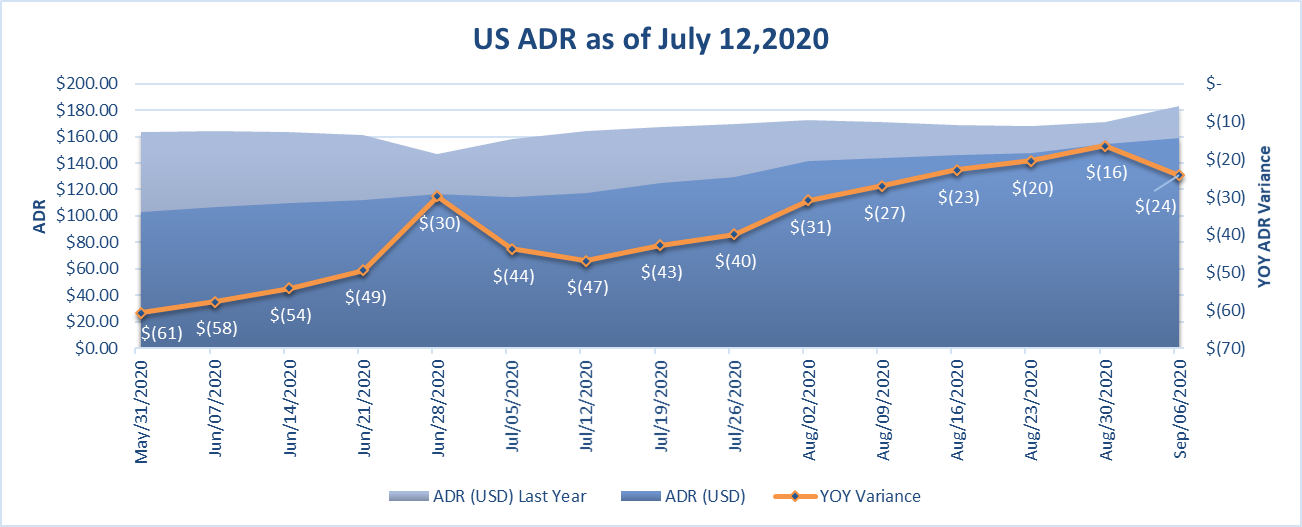

Rate Adjustments

Total average rates have declined between $30 – $60 in June and July. Lower rates suggest adjustments are being applied to the best available rate (BAR). It is important to keep in mind that reductions in average daily rate (ADR) could lead to more challenges in rebuilding your business as it is well documented that this often leads to extended recovery periods.

SOURCE: Demand360® data as of July 12, 2020

SOURCE: Demand360® data as of July 12, 2020

SOURCE: Demand360® data as of July 12, 2020

SOURCE: Demand360® data as of July 12, 2020

Interestingly, when we review a May 30 snapshot of US rates, we find that the ADR was down just $18 over last year for the week of July 5. The same snapshot of ADR performance as of July 12 shows the rate drop for the same week was down $44 over last year. Similar trends occur moving forward into the next several weeks of summer.

It begs the questions, why are hoteliers are not maintaining their rate in alignment with their value proposition. Are packages too operationally challenging to offer with limited staff? Are typical discounts too prohibitive to make readily available? Consider how you can provide value to your guests without dropping rate. Perhaps adding additional services that you can later remove from packages as consistent demand returns.

Looking ahead, the data suggests the industry is maintaining rates further into summer. Take the time now to identify ways to hold this rate. Current booking trends indicate a significant amount of market compression as a majority of guests are booking accommodations 0-7 days before travel. Dropping your rate weeks ahead of this has a lower likelihood of driving demand if guests expect to make a last-minute decision to travel. With relaxed cancellation policies, guests could catch on and cancel bookings they made further out in favor of last-minute rate drops closer to their stay dates.

Every hotelier is facing unique and drastically different circumstances from any past downturn. Relying on historical trends to predict what will happen in the current weeks and months is irrelevant. Use a forward-looking business intelligence solution to identify trends for your specific market, even going so far as to re-evaluate potential changes in your competitive set.

To support you in your recovery efforts, the teams at Amadeus and HSMAI have collaborated to bring you industry-leading best practices that you can consider when building, implementing, and monitoring your recovery strategy. As always, we’re here to help. Collaborating as an industry, we will recover and come back stronger than ever.