Katy Gettinger, Vice President Sales, Preferred Hotel and Resorts, HSMAI Sales Advisory Board Member

Kyle McEachran, Sales Strategy & Insights at Google Travel, HSMAI Sales Advisory Board Member

As the implementation of AI and hotels and hotel sales seems becomes more common, it’s really essential for sales leaders to stay in the know about this growing technology. That’s why we wanted to bring this topic, which can feel overwhelming, to the HSMAI Sales Advisory Board for discussion.

Introduction to Artificial Intelligence

At its core, Artificial Intelligence (AI) represents the capacity of machines and software to emulate human intelligence and perform tasks such as learning, reasoning, and understanding natural language. This technology, although not new, has gained significant traction in various sectors, propelled by innovations from leading tech giants like Google, Microsoft, Amazon, and Apple. AI excels in analyzing large amounts of data to derive meaningful insights and facilitate decision-making processes.

Where Are We Learning About AI?

Some mentioned their company’s adoption of tools like Microsoft Copilot Chat, marking a shift towards officially sanctioned AI applications. This aims to harness AI’s potential while safeguarding proprietary information. Security was a huge consideration for most of our group with someone joking that of the hundreds of AI applications, 99.5% of them would never be allowed to be used by their company.

Others mentioned self-taught AI skills and collaborative learning within teams, sharing successes and tips for effective usage. While social channels like YouTube and LinkedIn were mentioned as good sources of tutorials and prompt ideas. Some of the top-down approaches from IT didn’t resonate as well since they didn’t focus on practical applications of AI, from email automation to customer service enhancements, but more on what was and wasn’t allowed.

Use Cases

One compelling case study highlighted the efficiency of AI in planning unique culinary experiences for a large group. Utilizing AI, the team could quickly generate menus, source ingredients locally, and identify vendors, transforming a potentially days-long process into a matter of hours. This example illustrates AI’s capacity to augment human efforts, not replace them, by enabling high-level planning and execution.

Several members mentioned using AI driven HR systems that helped with review processing and making them more efficient, with better feedback.

The AI Journey

Overall, each person is going on their own unique journey with both understanding and implementing AI. Essentially, AI is the application of big data and understanding big data, and it’s a matter of understating how you can best utilize it for your benefit – whether that’s productive tasks like performance reviews or integrations into a CRM.

The best way to understand the data or AI is to look at your own objectives and tasks and try to work backwards from there.

Read Further:

AI in Hotels: A Complete Guide for the Hospitality Industry

Questions for your team:

- Who, where, and how we are educating ourselves and teams on AI?

- How and where have we seen success (or failures) in implementing AI in your Commercial Strategy?

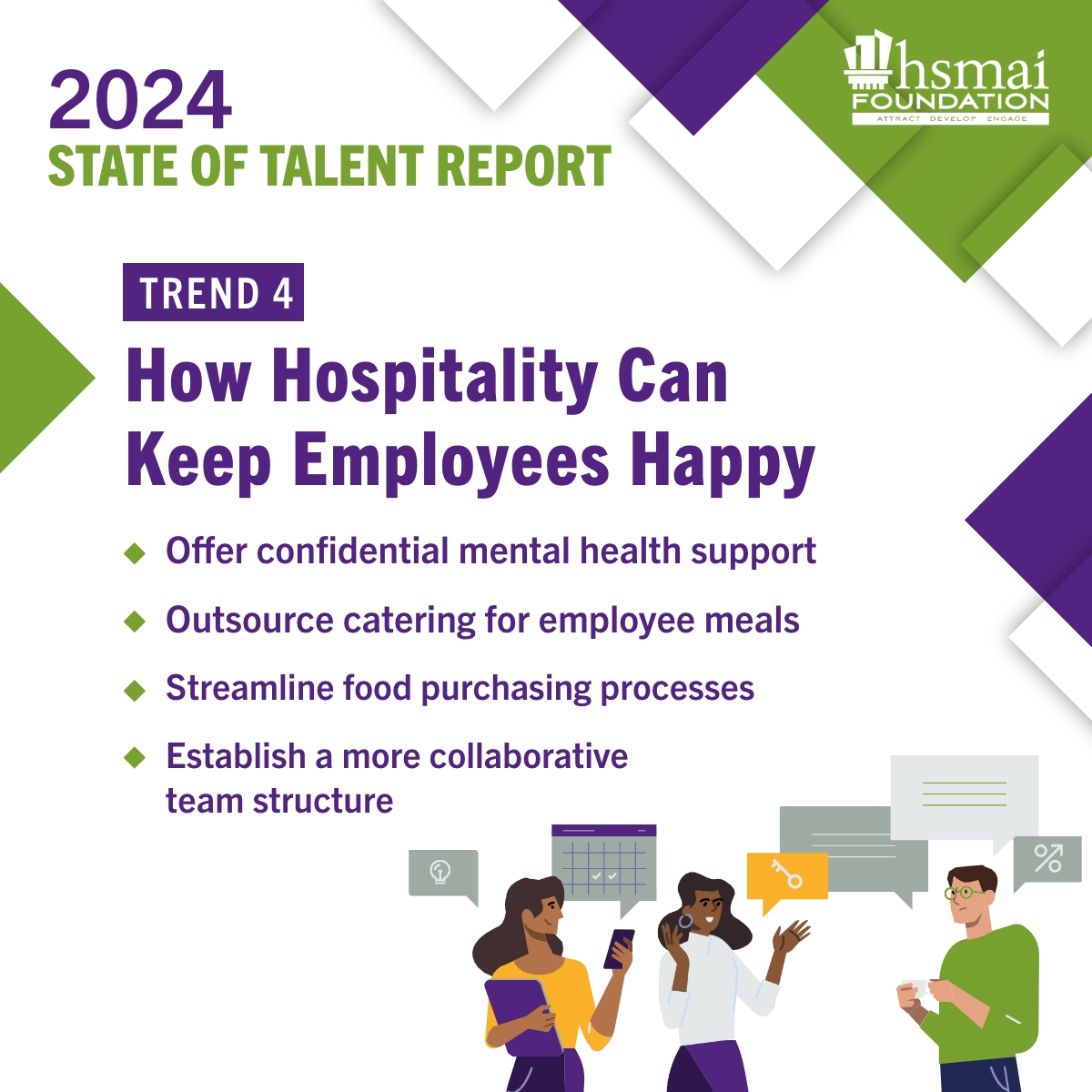

Expanding your organization’s mindset so that cross functional teams have contact and influence from initial development, marketing, and communication both internally and externally is seen as a necessary step for organizations. The emphasis is on preparation and recognizing that cross-functional teammates bring different skills, jargon, and viewpoints, and strong communication and agreed upon goals are important to prevent miscommunications which can become breeding grounds for conflict. These conflicts can not only slow down projects but can have a negative impact on employee well-being (Piaggi, 2023).

Expanding your organization’s mindset so that cross functional teams have contact and influence from initial development, marketing, and communication both internally and externally is seen as a necessary step for organizations. The emphasis is on preparation and recognizing that cross-functional teammates bring different skills, jargon, and viewpoints, and strong communication and agreed upon goals are important to prevent miscommunications which can become breeding grounds for conflict. These conflicts can not only slow down projects but can have a negative impact on employee well-being (Piaggi, 2023).

HSMAI staff recently sat down with Denise Thomas, the President of The Effective Communication Coach, who will be a keynote speaker at the

HSMAI staff recently sat down with Denise Thomas, the President of The Effective Communication Coach, who will be a keynote speaker at the  Q:

Q:

Historically, the hospitality industry measured employee engagement primarily through annual surveys, which eventually evolved into more frequent pulse surveys. While these surveys provided valuable insights, they often proved to be administratively burdensome and lacked the agility needed to address the dynamic and ever-evolving needs of the workforce. Importantly, the majority of hospitality businesses do not accurately measure the health of their culture, at a time when culture is a critical determinant of success.

Historically, the hospitality industry measured employee engagement primarily through annual surveys, which eventually evolved into more frequent pulse surveys. While these surveys provided valuable insights, they often proved to be administratively burdensome and lacked the agility needed to address the dynamic and ever-evolving needs of the workforce. Importantly, the majority of hospitality businesses do not accurately measure the health of their culture, at a time when culture is a critical determinant of success.