By Peggy Berg, Founder, Castell, an AHLA Foundation Project and Sarah Cozewith, VP Career Development, AHLA Foundation – For the HSMAI Foundation

The importance of elevating women in hospitality to senior executive roles cannot be overstated. Promoting diverse leadership strengthens business profitability and creates a culture of belonging and inclusion.

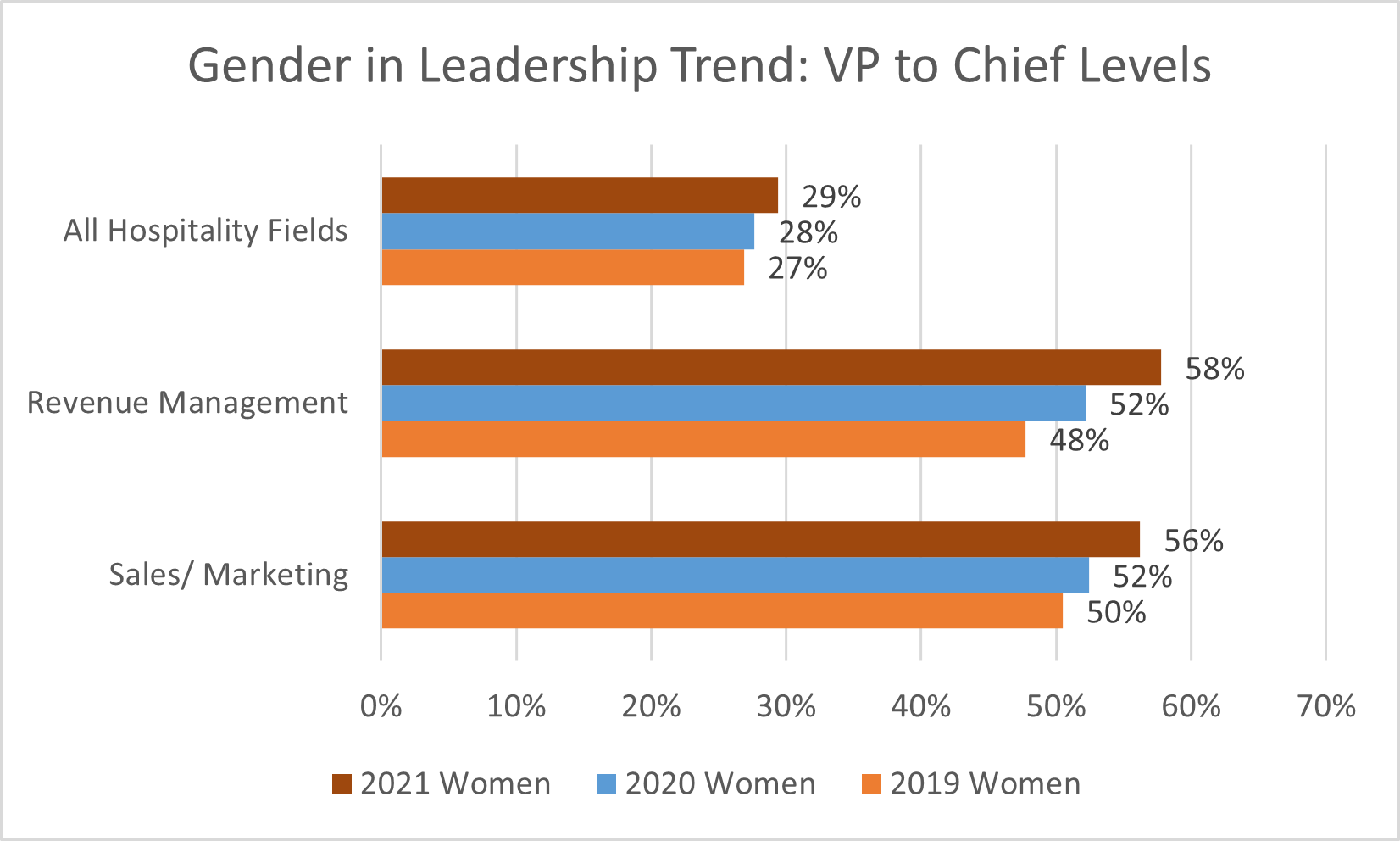

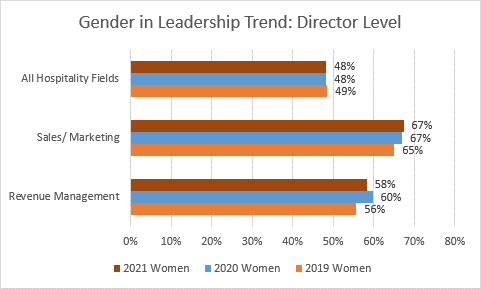

The good news is gender parity in hospitality is on the rise. In 2021, the industry saw more women in senior executive roles, successfully advancing every aspect of their companies. There are more women on the podium, building their careers and inspiring others. In sales and marketing and revenue management roles, gender representation of women significantly outpaced the general industry’s increase last year.

Across all hospitality fields, women hold 29 percent of positions from VP to Chief levels. However, in sales and marketing, women hold 56 percent of those positions and 58 percent in revenue management.

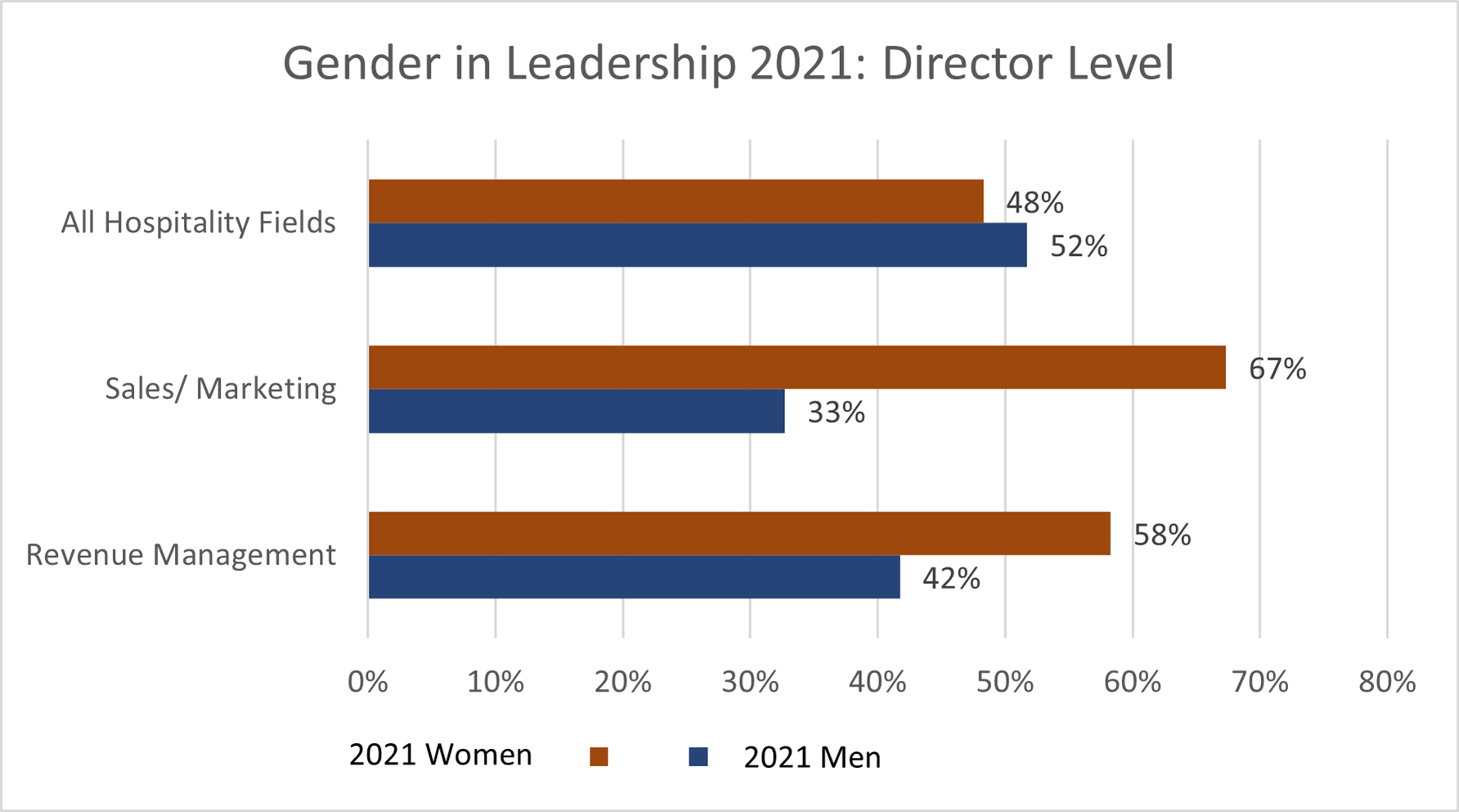

At the director level, women hold 67 percent of sales and marketing roles, indicating the disparity will increase toward women at higher levels in these fields over time. The director level has been skewed toward women for several years in these fields, highly impacting sales and marketing roles which are held by more than twice the number of women than men.

Is this a bad thing? Not necessarily, however, the potential implications require awareness and caution.

It’s difficult to attract men to fields dominated by women, just as it has been difficult to build female representation in male-dominated fields. For instance, attracting women to technology and finance has been challenging, while K-12 education and nursing have seen an increase in men, but remain strongly skewed toward women.

On average, diverse teams perform better across business endeavors. Diverse teams access a wider array of talent, connect to a broader market, and possess differentiated ideas and skills. When a field is dominated by one group, it becomes less desirable or exclusionary to others, and the access that comes from diversity suffers. There is also a compensation risk. Historically, “women’s jobs” have paid less. Gender balance is part of keeping compensation in fields like revenue management and marketing competitive with male-dominated fields like finance.

Recognizing the growing imbalance, it is important to deliberately attract and develop men as well as women to revenue management and sales and marketing careers.

AHLA and AHLA Foundation are proud to support women in hospitality with leadership programs tailored specifically to their advancement, including ForWard and BUILD and ELEVATE. A full report on Women in Hospitality Leadership 2022 is available at https://www.ahla.com/sites/default/files/women_in_hospitality_industry_leadership_0.pdf.

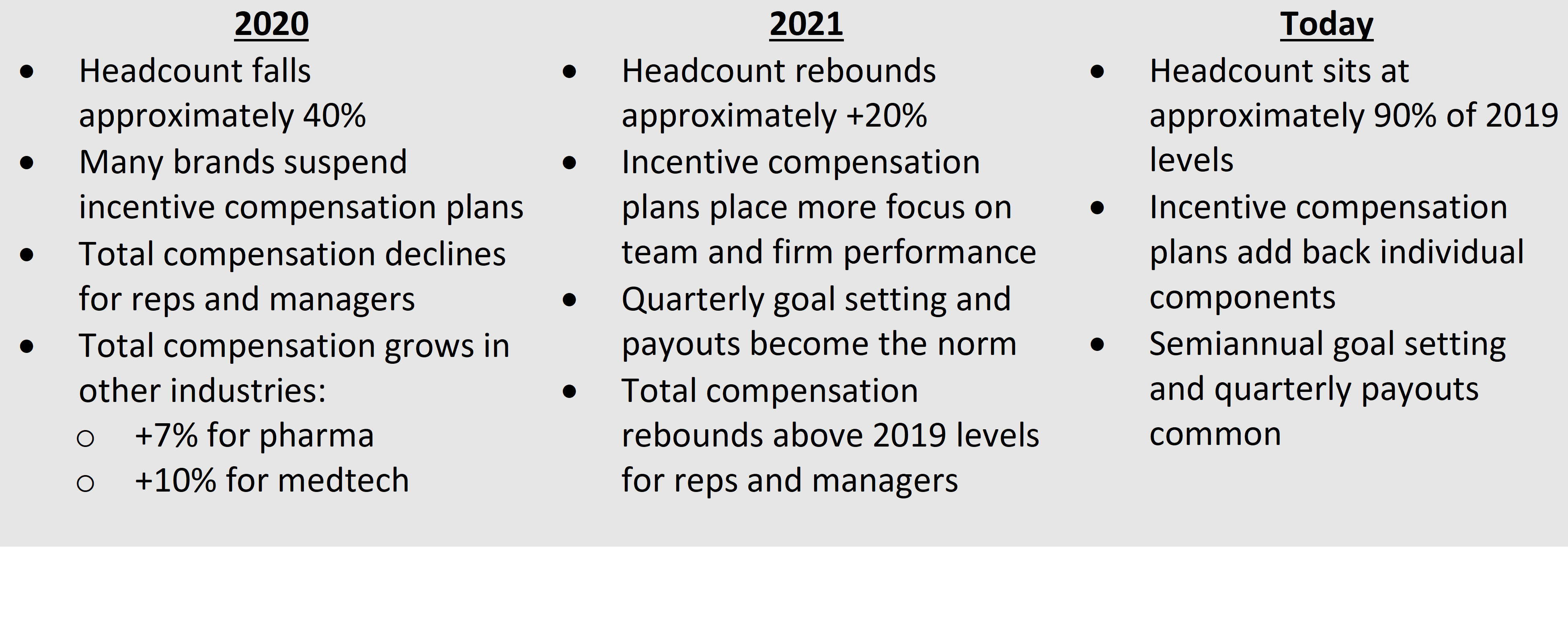

While we see a major rebound in incentive compensation in 2022, significant issues and challenges remain for hospitality brands, including:

While we see a major rebound in incentive compensation in 2022, significant issues and challenges remain for hospitality brands, including:

HSMAI recently honored the 2021

HSMAI recently honored the 2021