The pandemic and recovery have led to a rise in direct bookings, which makes metasearch more important than ever — and not just with the Big 5 channels.

By Dean Schmit, Founder, Base Camp Meta and MetaSeachMarketing.com

2021 is showing great promise of recovery for the hospitality industry. We’re already seeing increases in volume, with reports of locations such as Las Vegas posting their best month in eight years. Industry experts are cautiously optimistic.

However, this also means you have to start thinking — if you haven’t already — about your strategies for the months to come. Direct bookings will be more important than ever as the elimination of third-party cookie marketing will reinforce the need for website traffic. You can also look back at 2020 and realize how important it is to control guest communications in the event of emergencies. Metasearch has proven to be a key component of direct bookings, as it drives traffic to your website — providing first-party cookies — and provides your hotel with guests’ information.

With that in mind, HSMAI has partnered with my organization to create an educational series focused on metasearch programs. While Google is the giant when it comes to metasearch channels, you can find a plethora of content on this subject. Thus, we created this article to explore the world of metasearch beyond Google, including regional variances for marketing in South America, Europe, and Asia Pacific.

First, we have to provide some context by looking at the “Big 5” metasearch channels: Google, TripAdvisor, Trivago, Kayak, and Bing. These five channels are common players in almost every global market but may have variances by location. For example, you know that Google is the standard go-to metasearch channel, but what if you’re marketing to Chinese travelers who can’t access Google?

Let’s take a look at some of the metasearch channels beyond Google and also discuss some regional influences. We’ll start our tour in North America, where everyone talks about Google, so instead we’re going to look at the other four of the Big 5:

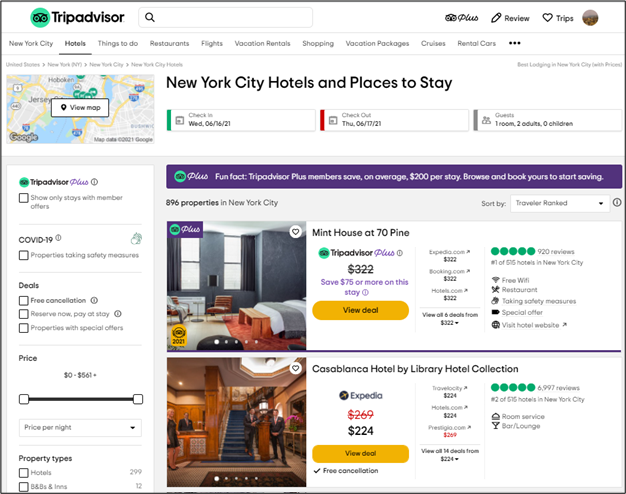

TRIPADVISOR

TripAdvisor gained much of its notoriety as a source for hotel guest reviews and user-generated content (UGC). The platform was one of the early implementers of assisted booking technology, called Instant Book, to help facilitate the metasearch booking process.

While TripAdvisor has had some ups and downs over the years, it has a strong niche market for travelers looking for and/or planning getaway vacations. TripAdvisor is ideal for hotels and resorts that want guests to “look at all the pretty pictures,” and continues to be a great resource not only for guest reviews but also for researching a destination: “What are the best restaurants and/or attractions near my hotel?”

TripAdvisor should always be a standard part of marketing programs for high end luxury properties, resorts, and destination marketing professionals.

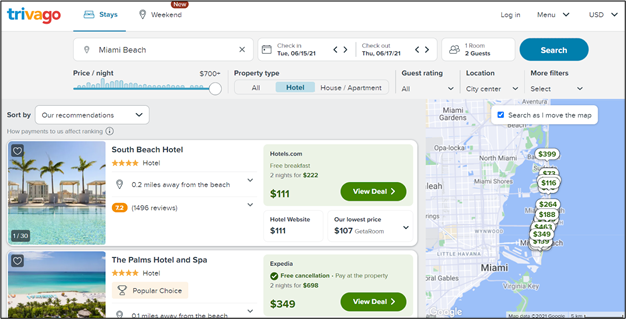

TRIVAGO

When we think of the Expedia-owned metasearch channel Trivago, we think of European travelers. This mentality has been a little misleading in past years as the platform also engaged in aggressive television marketing that appealed to U.S. travelers. Remember the Trivago Guy?

The international traveler demographic took a huge hit during the pandemic, as did Trivago’s television marketing budget. The company has started to reengage with display advertising as well as new TV ads focusing on vacation rentals.

Historically, Trivago has had the advantage of one of the lowest CPC metrics in the industry. While this was often paired with a lower conversion rate, it still could drive strong ROI due to low costs. This is a good channel to watch as an indicator for travel trends from other markets.

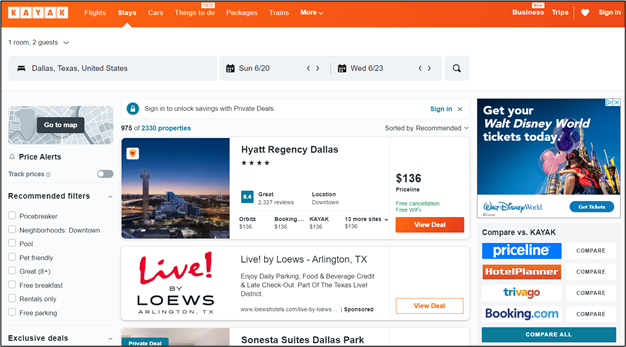

KAYAK

Giving credit where credit is due, Kayak has been running travel metasearch programs longer than any other major site on this list. It started in 2004 alongside a former competitor called Sidestep, which Kayak eventually acquired.

Kayak is now part of the Priceline family, which enables the platform to feature many of Priceline’s special rate programs such as Price Breakers within its search results. Kayak’s site also features a wide array of inline and popup ad opportunities, as seen in the image below:

Kayak’s recent acquisition of HotelsCombined has also positioned it very well for increased international awareness. And while Kayak has a history of excellent conversion rates, it has lacked the volume seen by other channels. A key area of strength right now stems from alternative lodging options, including B&Bs and even campgrounds/RV resorts. Plus, Kayak has many “children” sites around the world (see “South America,” below) that can be very influential in the right markets:

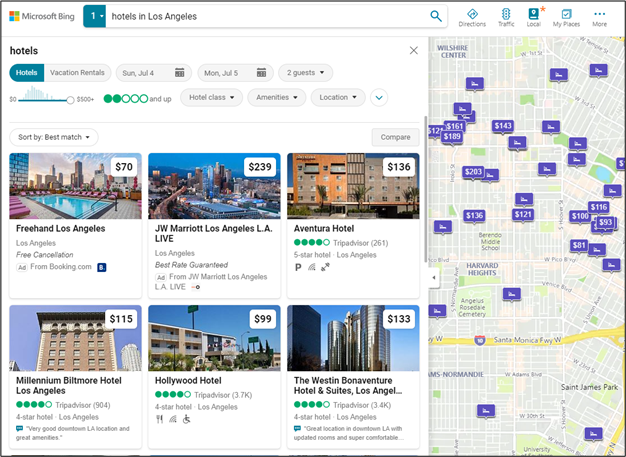

BING

Think of Bing as Google without the volume. Okay, done here.

But seriously, Bing is practically identical to Google, and you’ll find that its guest reviews and ratings are almost exclusively powered by TripAdvisor, so be sure to consider this association.

The advantage with Bing is that it actually performs very well. You could effectively “own” your presence there on a very small budget. The other thing to remember is that most vehicle navigation software programs are powered by Microsoft; as a result, when you ask your car’s GPS to find a hotel near you, it’s pulling that information from a Bing database.

Now that we have an overview of the Big 5 channels, let’s take a look at some regional variances:

SOUTH AMERICA

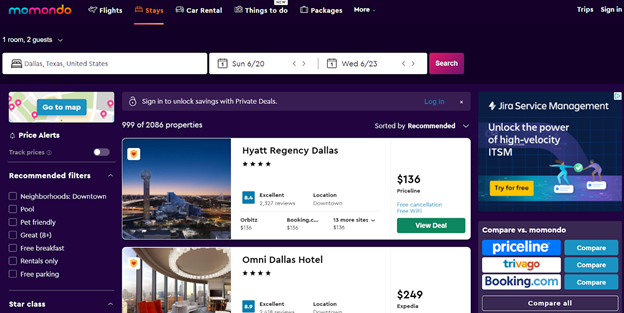

While Kayak itself is not a primary channel, many of the Kayak “children” are. These sites include Mundi, Momondo, and DetectaHotel, all of which are part of the Kayak/Booking Holding family. Other relevant metasearch channels include Voopter and Skyscanner; however, these are generally more focused on flights.

The Brazilian hotel market in particular consists of more than 80 percent independent hotels with a wide array of electronic distribution systems. This can make integrations challenging, and rates and availability often don’t work via two-way interfaces. It’s also a common practice for consumers to pay for travel in installments — over a 12-month period, for example — which can further complicate guarantee/cancel policies within the metasearch points of sale as they may not all offer this feature.

EUROPE

Europe tends to be a very diverse region for all travel programs, and metasearch is no exception. Trivago has long been the dominant player in the market pre-COVID, while TripAdvisor also holds a strong presence but more in the travel-planning stage rather than rate shopping.

Europe also saw a sharp increase in the percentage of traffic booking directly during COVID. Many consumers wanted the ability to speak directly with the hotel to have questions answered prior to travel.

Google dominates this market but is getting some competition from a lesser-known search engine called Ecosia, which demonstrates its commitment to ecological and carbon-friendly practices by planting a tree for every search. While Ecosia doesn’t yet have a metasearch point-of-sale component, it does follow more traditional SEM/SEO formats.

ASIA PACIFIC

Metasearch within the APAC market has changed drastically during COVID. The use of such engines has been heavily reduced due to the lack of international travel and the heavy regulation of domestic travel.

Pre-COVID, Google, TripAdvisor, Qunar (now Trip.com), and Kayak were the largest metasearch players, although you have to keep in mind that Google has limited access from within China. The one channel that does hold some prominence is TripAdvisor, due largely to consumers wanting to know if a particular hotel is safe — or for that matter even open. Beyond metasearch channels, much of the deal-searching within China is driven by livestream shows run by different online celebrities and/or channels.

THE LONG TAIL LIST

We could continue to list other metasearch channels across many additional pages. Sites like Hotelvoy, Hotelscan, Yandex, Allstay, and more have very region-specific audiences. Google will almost always be the dominant player in the room, but only focusing on that platform will mean you’re ignoring 25 to 40 percent of your market’s potential traffic.

The best solutions come from understanding consumer buying behavior for each channel and how that may or may not be relevant to your hotel and/or market. By combining this with a proper cross-channel optimization strategy, you can cast a wider net without losing focus on the bigger fish.

THE WRAP-UP

We’ve talked a lot about the various meta channels and their influences on regions around the world. Now what? Well, here are a few key action items you can take away from this article:

- If you’re not already doing so, make sure you have a point of sale on Google’s free organic meta (aka FBL for Free Booking Links). This is a must-do minimum, even if you do absolutely nothing else.

- If you’re running campaigns, make sure you have unique tracking to identify paid versus organic on Google.

- Identify your regional demographics and pair them up with channels best suited to your feeder markets (as described above).

- Track those first-party cookies! Not everyone books, and with third-party cookies on their way out, these are going to be extremely valuable.

- Run campaigns, even if they have to be modest ones. Meta CPCs continue to be very low, but we can already see them increasing as we head into the summer months. Running a baseline campaign can be very inexpensive but will provide you with valuable historical data and help you identify key trends.

Take advantage of a new Navigating Metasearch on-demand course to learn more about these specialized marketing programs.